Simply MFs! SEBI guidelines make investing in mutual funds fairly simple now

ompared to its global peers, India ranks high when it comes to domestic savings rate and overall savings pool. Yet, being a conservative society, the dominance of traditional financial

instruments such as bank deposits and public provident fund (PPF) over modern tools such as mutual funds (MF) and unit-linked insurance plans (ULIP) still prevails.

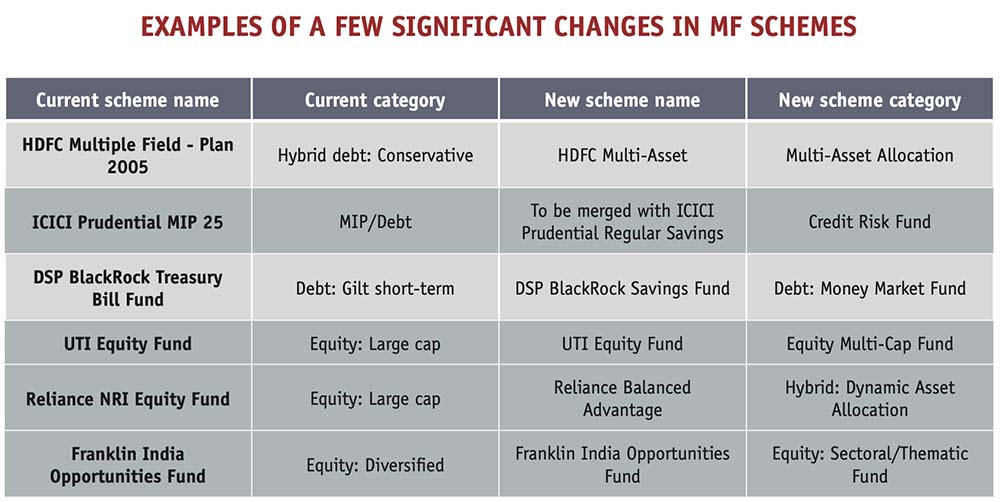

The lack of enthusiasm for modern financial instruments can be attributed to a dearth of market awareness and confusion created by scores of schemes and strategies. Moreover, terminologies used while marketing these products can be confusing too. Adding fuel to the fire, sometimes MFs try to re-brand with a fancy name.

ENTER SEBI

Financial gurus, distributors, asset management companies and industry associations have long debated and tried to resolve the above issue without much success. However, we see a ray of hope in the form of market regulator Securities and Exchange Board of India’s (SEBI) guidelines to mutual funds to categorise and rationalise their schemes by June 2018.

Here is a summary of SEBI’s announcement: l Rationalisation of schemes into below categories and

subcategoriess:

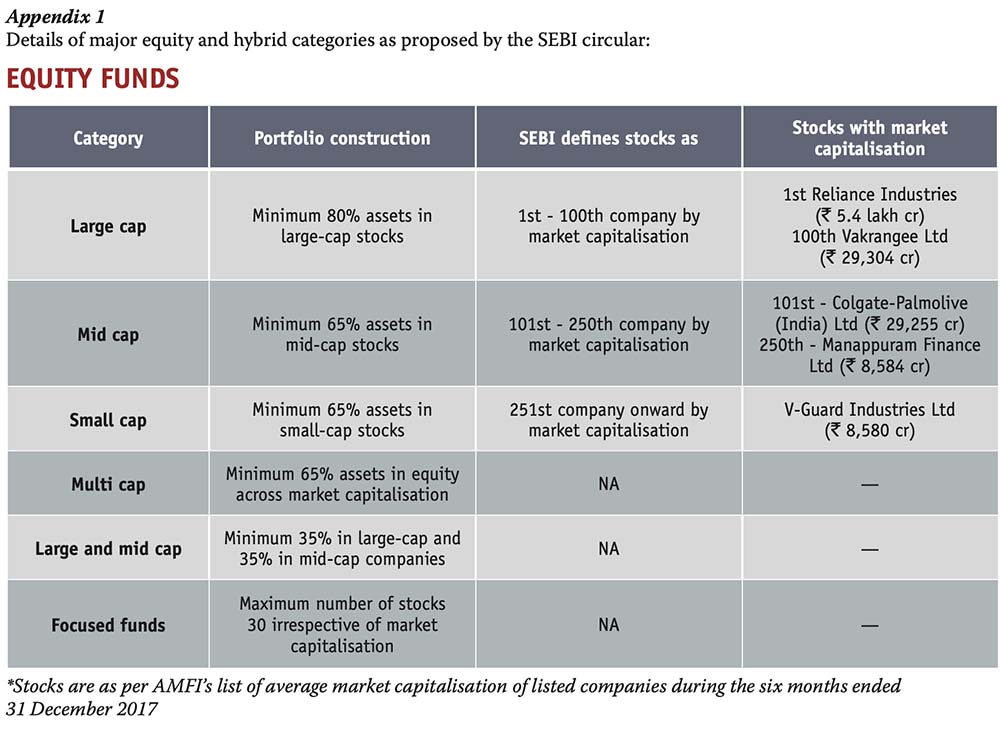

Equity (10 subcategories)

Debt (16 subcategories)

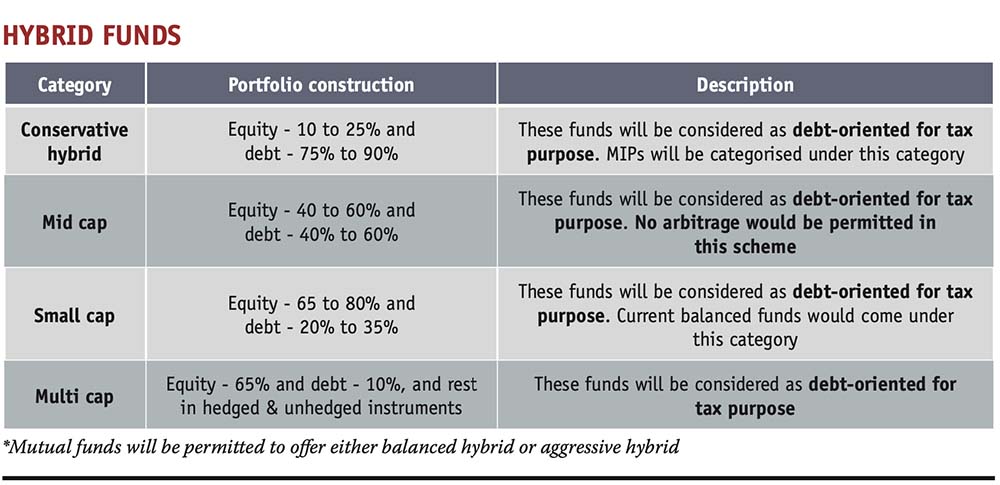

Hybrid (six subcategories)

Solution-oriented (two subcategories)

Others include index funds, exchange traded funds and fund of funds (two subcategories) (See Appendix 1 for more details)

- Each fund house can have only one scheme in each category. So only one large-cap fund, only one taxsaving fund, etc with the exception being sector funds, exchange traded funds and fund of funds.

- Once such a scheme has been classified to a category, it cannot change the same and the fund manager has to comply with the mandate.

- Unlike the past, now SEBI has clearly set the definition for each category and each fund house does not have the authority to change it.

The advantages

The new guidelines bring in several advantages for investors, namely: l Fund categories are simpler to understand.

- Risks and rewards associated with each category is easier to explain, helping in quicker decision making.

- Ambiguity and chaos created by “unnecessary and high-pitch” advertisement campaigns gets substantially reduced.

- Bonus on the fund manager for his performanceincreases several-fold.

- Long list of duplicate schemes will now be merged or reclassified.

- Easier to compare similar schemes across fund houses.

STEP 1

Carefully understand the changes in the schemes held in the portfolio (in case of doubt, contact us or your financial advisor)

STEP 2

Status quo if the change is only in the name

STEP 3

If the key attributes have changed and don’t meet your financial goals any longer, you need to reallocate your portfolio.

Important: There is no need to panic as the changes seen so far are in a few funds, whereas most schemes continue to get only consolidated.

In short, investments should be based on well-researched facts, a fair understanding of the schemes and not rumours. In case you have any query regarding long-term investing, feel free to write to me at dhm@ethicaladvisers.in

The lack of enthusiasm for modern financial instruments among silvers and those with a non-financial background can be attributed to a dearth of market awareness and confusion created by scores of schemes and strategies